Tesla Battery Day 2020 – Significant, But Not Immediate

[Sept. 24, 2020]

Tesla’s highly anticipated “Battery Day” on Sept. 22, 2020, while met with great interest by the company’s and Elon Musk’s die-hard fans, landed with a thud among the investment community, with the share price down more than 10 percent at the end of the trading day on Sept. 23.

I think this is a classic example of the investment community’s “quarter-to-quarter” thinking, and hopes and expectations for instant gratification. Perhaps it was conditioned by past Tesla announcements and events where the announcement of pre-orders or sales in the next weeks or months, rather than years out, were the expectation.

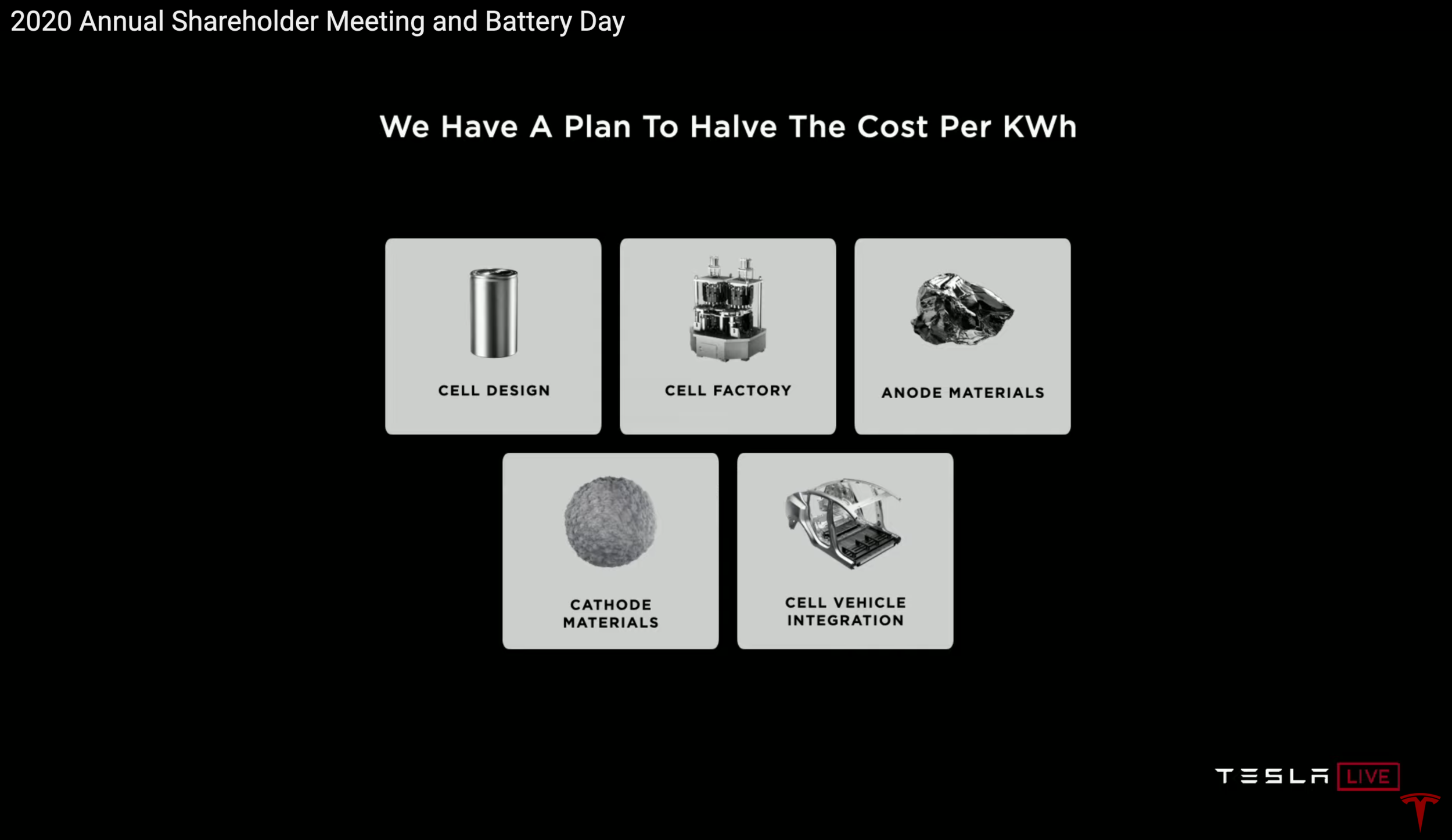

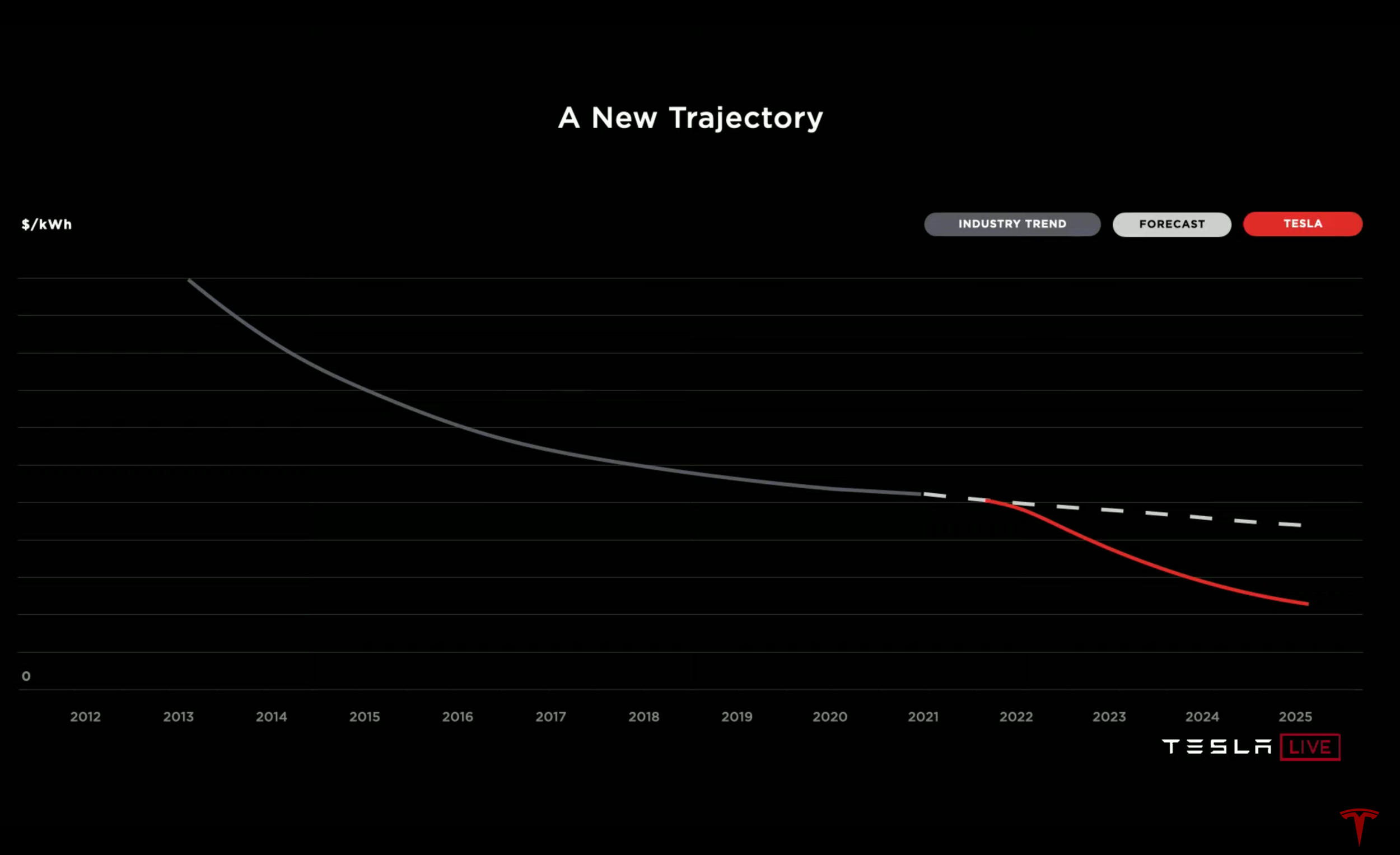

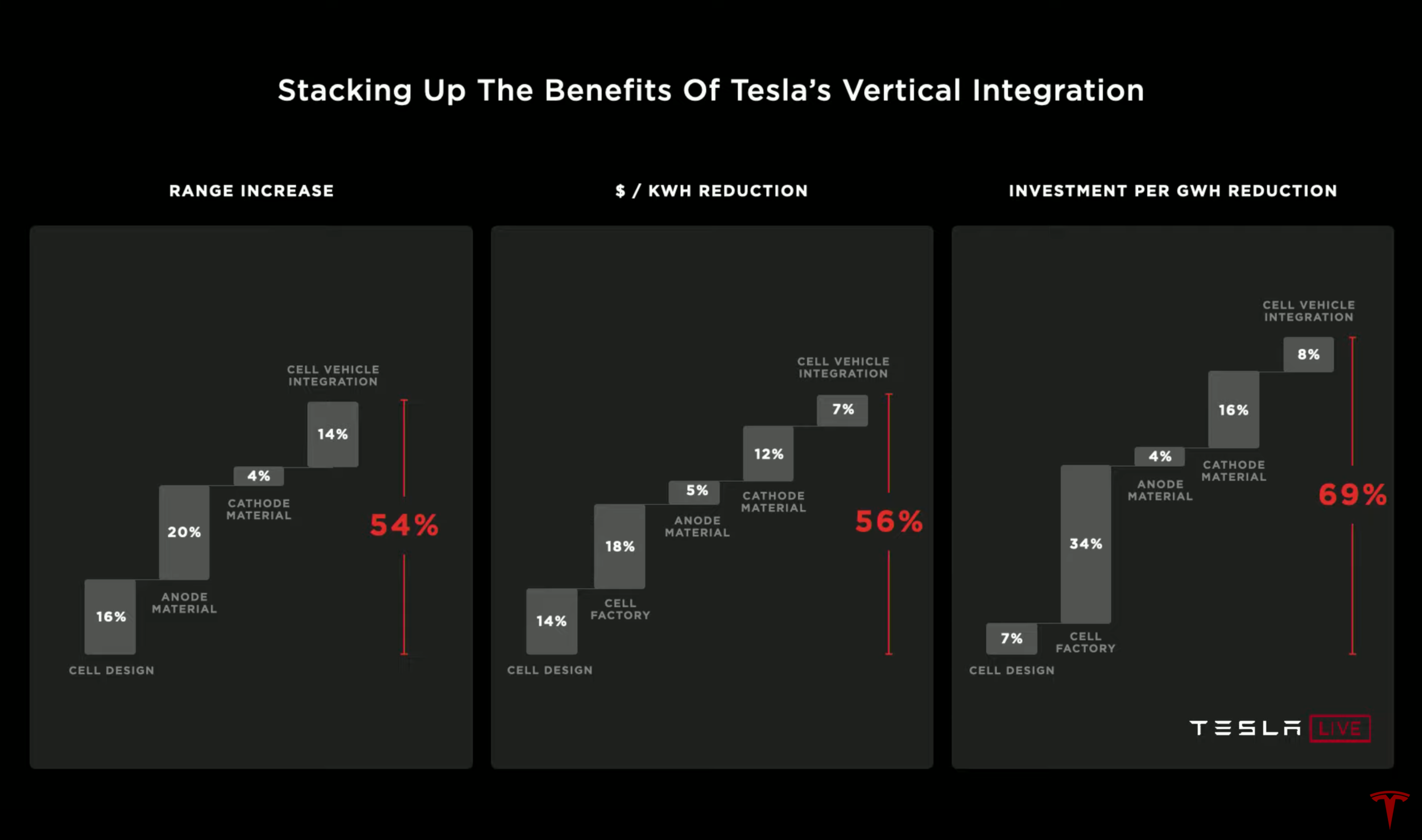

Musk and senior vice president of Powertrain and Energy Engineering Drew Baglino unveiled some strategically and technologically significant breakthroughs in battery and vehicle construction that, over the course of the next two to three years, could have tectonic implications for the company and the broader EV and even minerals mining sectors. But the investment community was hoping for an immediate “quick hit” that would satisfy its need for news or justification for the company’s sky-high (by typical metrics) market valuation.

Was the market’s seeming punishment of Tesla the following trading day justified? Perhaps not. Then again, arguably neither is the stock’s meteoric rise over the last several quarters. Tesla stock remains a lightning rod for controversy and differing opinions, with share price targets ranging from $19 to more than $1,400. Clearly, this probably isn’t an appropriate stock for retirees looking for a stable, conservative investment.

But let’s take a longer-term perspective on some of the news from Battery Day 2020. One of the persistent criticisms of EVs has been their high relative initial purchase price compared to conventional cars. Although there are deals to be had on selective EVs that dealers have been unable to sell, by and large, EVs still carry a significant price premium compared to their internal-combustion equivalents.

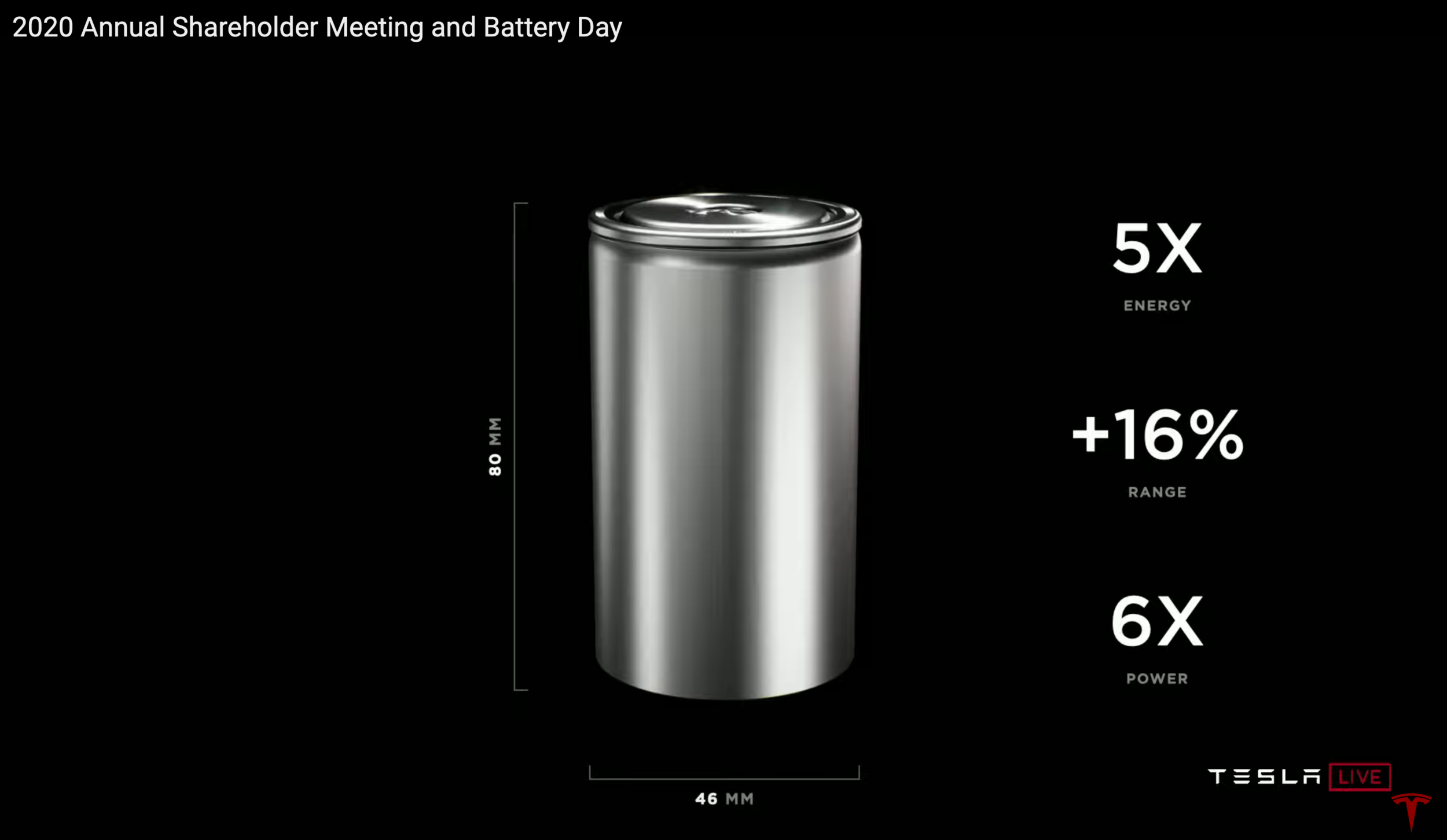

Tesla teased the prospect of a mass-market $25,000 EV, enabled by the economies of scale and more efficient production processes of the new 4680 battery cells, and using the cells and battery pack as a structural member of the vehicle. No renderings were shown of the concept vehicle. In addition to enabling a new, lower-cost “global” C-segment car (think VW Golf or Ford Focus), the higher-power cells would also enable power-hungry applications like the Cybertruck and Semi.

The big letdown (for some) is that production of these new cells was not slated to happen in any significant volume until 2022 – and even the Model S Plaid that was also announced is a year away from the streets. And that’s on “Musk time.” As anyone who has followed the company and its leader knows, Tesla production targets can be famously elusive. So it’s entirely possible that the battery target could slip into 2023. The inference that the 4680 cells would be the basis for the Cybertruck and Semi packs was interpreted by many to mean that the launch of those two products could be pushed out as well.

Meanwhile, California Governor Gavin Newsom signed an executive order on Sept. 23, 2020, banning the sale of new internal-combustion vehicles in the state by 2035. Whether this action will have any bearing on Tesla’s stock price remains to be seen. But there’s little disputing that Tesla is still decisively in the lead when it comes to EV production and technological development. But 15 years is still a long way out, and gives the cynics, critics, and bears plenty of time to stir the pot.

In full disclosure, I own shares in Tesla, and am in it for the long haul. Personally, I’m a long-term bull, and don’t intend on selling any time soon, unless unforeseen personal financial circumstances dictate otherwise. There’s a chance Tesla could be out of business in 2035. There’s also a chance they could have a $1 trillion-plus market valuation. As of right now, my money’s on the latter.

(Images courtesy Tesla)

Follow us on Google News and like us on Facebook!